SBA Form 5 2018-2025 free printable template

Show details

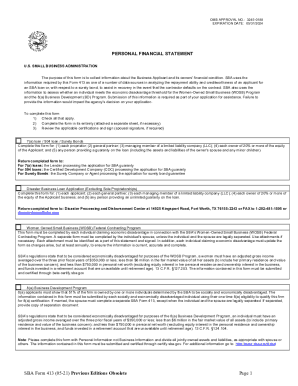

INSURANCE COVERAGE IF ANY Inventory Leasehold Improvements Coverage Type Name of Insurance Company and Agent Phone Number of Insurance Agent SBA Form 5 02-15 Ref SOP 50 30 Policy Number 17. 19. Regarding you or any joint applicant listed in Item 17 a are you presently subject to an indictment criminal information arraignment or other means by which formal criminal charges are brought in any jurisdiction b have you been arrested in the past six months for any criminal offense c for any...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sba disaster loan application form

Edit your sba disaster loan application pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba loan disaster form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit the SBA disaster loans log online

1

Sign into your account. If you are new, start your free trial.

2

Add your document. Click on Add New from your Dashboard to import a file. You can upload it from your device, cloud, or internal mail.

3

Edit the SBA disaster loans log. You can add or replace text, insert objects, rearrange pages, and add watermarks and page numbers. Click Done when you finish editing, and you can manage the file in the Documents tab.

4

Retrieve your file. Find your file in the documents list, select its name, and choose how to save it. Options include saving the PDF, emailing it, or moving it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SBA Form 5 Form Versions

Version

Form Popularity

Fillable & printabley

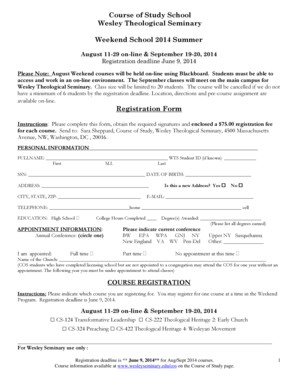

How to fill out sba disaster loan requirements form

How to fill out sba disaster loans log

01

Begin by downloading the SBA disaster loans log PDF from the official SBA website.

02

Fill out the SBA disaster loans log form with your business's legal name.

03

Provide your business's physical and mailing addresses in the appropriate fields.

04

Enter your business's Tax Identification Number (TIN) for accurate identification.

05

Specify the type of business structure, such as sole proprietorship or corporation.

06

Include details about ownership and management to complete the form.

07

Clearly state the reason for your loan request and specify the amount you need.

08

Summarize your business's financial condition, noting existing debts where applicable.

09

Sign and date the form before you submit it to the SBA for review.

Who needs sba disaster loans log?

01

Small Business Owners: Businesses looking to secure funding through SBA disaster loans can benefit from this log.

02

Startups: Entrepreneurs seeking fresh financial backing to launch or grow their ventures should utilize this log.

03

Nonprofits and Organizations: Organizations needing to provide evidence of their eligibility for SBA assistance programs can find this resource useful.

Fill

disaster loan application form

: Try Risk Free

People Also Ask about sba form 2483

What is an SBA form?

Purpose of this form: The purpose of this form is to collect information about the Small Business Applicant ("Applicant") and its owners, the loan request, existing indebtedness, information about current or previous government financing, and certain other topics.

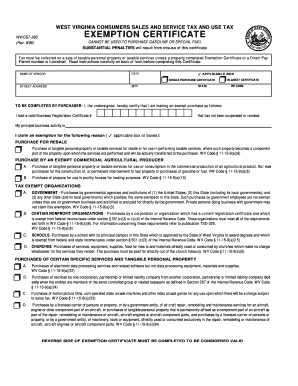

What should be included in schedule of liabilities?

Information that is needed for Schedule of Liabilities 1.Name of Creditor 2. Original amount due 3. Original date due 4. Current balance 5.

What is the schedule of liabilities for SBA 2202?

What Is SBA Form 2202? SBA Form 2202, Schedule of Liabilities is a format suggested by the Small Business Administration (SBA) for describing all fixed debts that should supply a balance sheet. The form is used by small business owners when applying for an SBA Disaster Loan.

What documents do the SBA need?

Include records of any loans the small business owner may have applied for in the past. Include the business' signed federal income tax returns for the previous three years. Include personal resumes for each principal. Provide a history of the business and its challenges.

What is SBA form 5?

What Is SBA Form 5? SBA Form 5, Disaster Business Loan Application is a form used by business owners to request financial assistance in repairing or replacing real estate or business property damaged during a natural disaster.

Why does SBA need my tax return?

SBA also uses Internal Revenue Service (IRS) verification of tax return and financial statement information to detect fraud by program applicants or participants.

What are liabilities for SBA?

A business's financial obligations—like SBA 7(a) loan payments, salaries, mortgages, and deferred payments—are considered liabilities. Liabilities are deducted from a business's total equity. A business will settle liabilities over time by paying them off, or by trading goods or services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find the SBA disaster loans log?

With pdfFiller, an all-in-one online tool for document management, you can easily fill out forms. Our website offers over 25 million options, and you can quickly locate the SBA disaster loans log. Open it now and customize it using advanced editing tools.

How do I fill out the SBA disaster loans log online?

pdfFiller simplifies filling out and eSigning the SBA disaster loans log. The application allows you to modify content, add fillable fields, and sign the document electronically. Start a free trial to explore the features of pdfFiller, the top solution for document editing.

How do I edit the SBA disaster loans log on an iOS device?

Use the pdfFiller app for iOS to create, edit, and share the SBA disaster loans log from your phone. You can find and download the app from the Apple Store. Take advantage of a free trial and select a subscription plan that meets your needs.

Fill out your SBA Form 5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Disaster Loan Application is not the form you're looking for?Search for another form here.

Keywords relevant to sba eidl loans

Related to sba disaster loan forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.